PROXY STATEMENT AND NOTICE OF

2020 ANNUAL MEETING OF SHAREHOLDERS

April 29, 2020

As filed with the Securities and Exchange Commission on March 21, 2017February 27, 2020

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(RULE14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| Preliminary Proxy Statement | ||

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | |

| Definitive Proxy Statement | ||

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant toSection 240.14a-12 | |

GLOBAL PAYMENTS INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | ||||

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. | ||||

| 1) | Title of each class of securities to which transaction applies:

| ||||

| 2) | Aggregate number of securities to which transaction applies:

| ||||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| ||||

| 4) | Proposed maximum aggregate value of transaction:

| ||||

| 5) | Total fee paid:

| ||||

| ☐ | Fee paid previously with preliminary materials. | ||||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | ||||

| 1) | Amount previously paid:

| ||||

| 2) | Form, Schedule or Registration Statement No.:

| ||||

| 3) | Filing Party:

| ||||

| 4) | Date Filed:

| ||||

PROXY STATEMENT AND NOTICE OF

2020 ANNUAL MEETING OF SHAREHOLDERS

April 29, 2020

3550 Lenox Road

Atlanta, Georgia 3032130326

(770) 829-8991829-8000

March 21, 2017, 2020

Dear Shareholder:

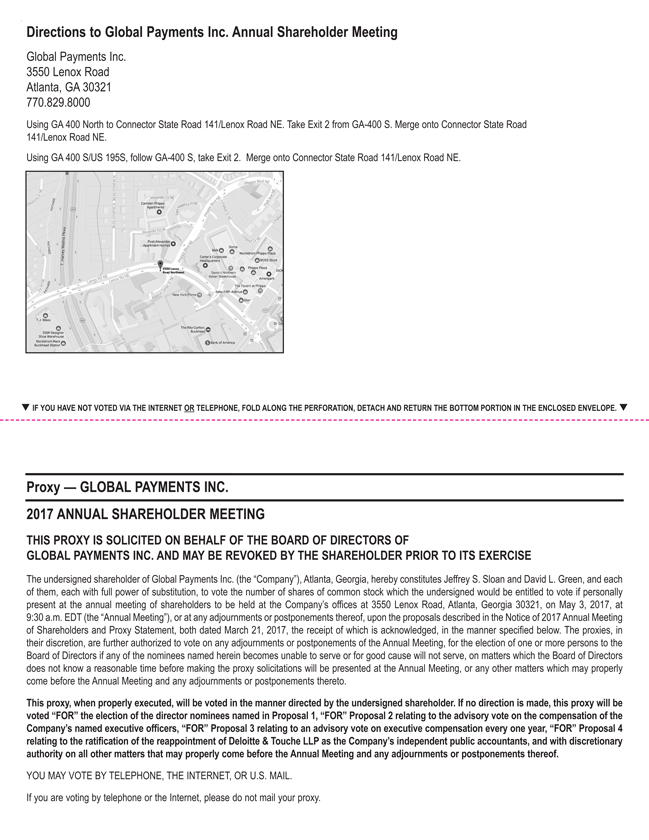

The board of directors and officers of Global Payments Inc. join me in extending to you a cordial invitation to attend our 2017 annual meeting2020 Annual Meeting of shareholders.Shareholders. The meeting will be held on Wednesday, May 3, 2017,April 29, 2020, at 9:30 a.m. Eastern Daylight Time, at our offices at 3550 Lenox Road, Atlanta, GA 30321.30326. At the annual meeting, shareholders will be asked to vote on four proposals set forth in the Notice of 20172020 Annual Meeting of Shareholders and the proxy statement following this letter.

In the third quarter of 2019, we completed our merger with Total System Services, Inc., bringing together two industry leaders and positioning the new Global Payments as a premier pure play payments technology company at scale globally. Importantly, the merger accelerates our technology-enabled software-driven strategy, establishing Global Payments as a leading provider of integrated payment solutions, owned software in both merchant and issuing, ande-commerce and omni-channel capabilities. We are pleased to welcome the former shareholders of TSYS to our company and look forward to engaging with you.

Whether or not you plan to attend the annual meeting, it is important that your shares are represented and voted regardless of the size of your holdings. We urge you to vote promptly and submit your proxy via the internet, by telephone or by signing, dating and returning the enclosed proxy card in the enclosed envelope. If you decide to attend the annual meeting, you will be able to vote in person, even if you have submitted your proxy previously.

If you have any questions concerning the annual meeting and you are the shareholder of record of your shares, please contact our Investor Relations department at Investor.Relations@globalpay.com or (770)829-8478. If your shares are held by a broker or other nominee (that is, in “street name”), please contact your broker or other nominee for questions concerning the annual meeting.

We look forward to seeing you on May 3.April 29.

Sincerely, | ||

|

| |

| Jeffrey S. Sloan | ||

| Chief Executive Officer | Chairman of the Board | |

NOTICE OF 2020 ANNUAL MEETING OF SHAREHOLDERS

April 29, 2020 9:30 a.m. Eastern Daylight Time | ||

3550 Lenox Road Atlanta, Georgia |

|

Items of Business

| 1. | To elect the |

| 2. | To approve, on an advisory basis, the compensation of our named executive |

| 3. | To approve |

| 4. | To ratify the reappointment of Deloitte & Touche LLP, or Deloitte, as the Company’s independent public accounting firm for the year ending December 31, |

The shareholders may also transact any other business that may properly come before the annual meeting or any adjournments or postponements thereof.

Record Date

Close of business on March 3, 2017.6, 2020.

On March 21, 2017,, 2020, we mailed a notice of electronic availability of proxy materials to our shareholders. Only shareholders of record at the close of business on March 3, 20176, 2020 are entitled to receive notice of, and to vote at, the annual meeting or any adjournment or postponement thereof. If you do not attend the annual meeting, you may vote your shares via the internet or by telephone, as instructed in the Notice of Electronic Availability of Proxy Materials, or if you received your proxy materials by mail, you may also vote by mail.

YOUR VOTE IS IMPORTANT

Submitting your proxy does not affect your right to vote in person if you attend the annual meeting. Instead, it benefits us by reducing the expenses of additional proxy solicitation. Therefore, we urge you to submit your proxy as soon as possible, regardless of whether or not you expect to attend the annual meeting. You may revoke your proxy at any time before its exercise by (i) delivering written notice of revocation to our Corporate Secretary, David L. Green, at 10 Glenlake Parkway, North Tower,3550 Lenox Road, Suite 3000, Atlanta, Georgia 30328-3473,30326, (ii) submitting to us a duly executed proxy card bearing a later date, (iii) voting via the internet or by telephone at a later date, or (iv) appearing at the annual meeting and voting in person; provided, however, that no such revocation under clause (i) or (ii) shall be effective until written notice of revocation or a later dated proxy card is received by the Corporate Secretary at or before the annual meeting, and no such revocation under clause (iii) shall be effective unless received on or before 11:59 p.m., Eastern Daylight Time, on May 2, 2017.April 28, 2020.

When you submit your proxy, you authorize Jeffrey S. Sloan and David L. Green, or either one of them, each with full power of substitution, to vote your shares at the annual meeting in accordance with your instructions or, if no instructions are given, for the election of the director nominees; for the approval, on an advisory basis, of the compensation of our named executive officers; for a frequencythe amendment to our articles of every year (1 year) of future advisory votes on compensation of our named executive officers;incorporation; and for the ratification of the reappointment of Deloitte as the Company’s independent public accounting firm. The proxies, in their discretion, are further authorized to vote on any adjournments or postponements of the annual meeting, for the election of one or more persons to the board of directors if any of the nominees becomes unable to serve or for good cause will not serve, on matters which the board does not know a reasonable time before making the proxy solicitations will be presented at the annual meeting, or any other matters which may properly come before the annual meeting and any postponements or adjournments thereto.

By Order of the Board of Directors,

|

|

David L. Green Senior Executive Vice President, General Counsel and Corporate Secretary |

| 1 | ||||

| 1 | |||

1 | ||||

1 | ||||

2 | ||||

3 | ||||

4 | ||||

5 | ||||

6 | ||||

7 | ||||

8 | ||||

8 | ||||

9 | ||||

9 | ||||

Questions and Answers About Our Annual Meeting and this Proxy Statement | 10 | |||

14 | ||||

| Board and Corporate Governance | ||||

| 21 | ||||

21 | ||||

21 | ||||

22 | ||||

23 | ||||

24 | ||||

27 | ||||

28 | ||||

29 | ||||

30 | ||||

31 | ||||

31 | ||||

| 32 | ||||

32 | ||||

33 | ||||

34 | ||||

Proposal Two: Advisory Vote to Approve the 2019 Compensation of Our Named Executive Officers | ||||

37 | ||||

39 | ||||

39 | ||||

42 | ||||

44 | ||||

44 | ||||

46 | ||||

49 | ||||

49 | ||||

50 | ||||

50 | ||||

51 | ||||

52 | ||||

Grants of Plan-Based Awards in | 54 | |||

56 | ||||

Stock Options Exercised and Stock Vested | 58 | |||

58 | ||||

59 | ||||

Potential Payments | 59 | |||

| ||||

| 67 | ||||

69 | ||||

70 | ||||

71 | ||||

| ||||

72 | ||||

| ||||

72 | ||||

Delinquent Section 16(a) | 72 | |||

73 | ||||

| ||||

This summaryWe provide below highlights of certain information contained elsewhere in this proxy statement, but does not contain all of the information you should consider before voting your shares.Proxy Statement. As previously reported, on July 27, 2016, our board of directors authorizedit is only a change in our fiscal year to a calendar year-end, following a seven-month transition period from June 1, 2016 to December 31, 2016, which wesummary, please refer to herein as the “2016 fiscal transition period.” As a result, this shareholder meeting is being accelerated to coincide with the new fiscal year end. For complete information regarding the 2017 annual shareholder meeting, which we refer to as the “annual meeting,” the proposals to be voted on at the annual meeting, and our performance during the 2016 fiscal transition period, please review the entire proxy statement and our Transition2019 Annual Report on Form 10-K for the 2016 fiscal transition period, or the Transition Report on Form 10-K. In this proxy statement, the “Company,” “we,” “our” and “us” refer to Global Payments Inc. and its consolidated subsidiaries, unless the context requires otherwise.before you vote.

Information About Our 20172020 Annual Meeting of Shareholders

| Date and Time: | Wednesday, | |

| Place: | Our offices at 3550 Lenox Road, Atlanta, Georgia, | |

| Record Date: | March | |

| Voting: | Holders of our common stock as of the close of business on the record date may vote at the annual meeting. Each shareholder is entitled to one vote per share for each director nominee and one vote per share for each of the other proposals described below. | |

Proposals and Voting Recommendations

Proposal | Board Vote Recommendation | Page Number | ||||||||||||||

| ||||||||||||||||

1 – Election of | FOR each nominee | 14 | ||||||||||||||

2 – Advisory Vote on Compensation of Our Named Executive Officers | FOR | 35 | ||||||||||||||

3 – | FOR | 67 | ||||||||||||||

4 – Ratification of the Reappointment of Our Independent Public Accounting Firm | FOR | |||||||||||||||

Recent Developments

On September 18, 2019, we consummated our merger with Total System Services, Inc., or TSYS, pursuant to which TSYS merged with and into Global Payments, with Global Payments as the surviving company. The merger positions us as a leading pure play payments technology company providing innovative payments and software solutions to approximately 3.5 million merchant locations and over 1,300 financial institutions across more than 100 countries throughout North America, Europe, Asia Pacific and Latin America.

2016 Fiscal Transition PeriodBusiness and Strategy

We seek to leverage the adoption of, and transition to, card, electronic and digital-based payments by expanding our share in our existing markets through our distribution channels and service innovation, as well as through acquisitions to improve our offerings and scale. We also seek to enter new markets through acquisitions, alliances and joint ventures around the world. We intend to continue to invest in and leverage our technology infrastructure and our people to increase our penetration in existing markets.

The key tenets of our strategy include the following:

Grow and control our direct distribution by adding new channels and partners, including expanding our ownership of additional enterprise software solutions with a payments overlay in select vertical markets;

Deliver innovative services by developing value-added applications, enhancing existing services and developing new systems and services to blend technology with customer needs;

Continue to develop seamless multinational solutions for leading global customers;

Leverage technology and operational advantages across our business segments and throughout our global footprint;

Provide customer service at levels that exceed our competition, while investing in technology, training and enhancements to our service offerings; and

GLOBAL PAYMENTS INC. |2020 Proxy Statement– 1

Pursue potential domestic and international acquisitions of, investments in and alliances with companies that have high growth potential, significant market presence, sustainable distribution platforms and/or key technological capabilities.

We experienced strong business and financial performance around the world during the year ended December 31, 2019. Highlights related to our financial condition and results of operations as of December 31, 2019 and for the year then ended include the following:

Consolidated revenues were $4,911.9 million and $3,366.4 million for the years ended December 31, 2019 and 2018, respectively. Consolidated revenues increased by 27.3%45.9% from 2018 to $2.2 billion2019.

Consolidated operating income was $791.4 million for the 2016 fiscal transition period from $1.7 billionyear ended December 31, 2019 compared to $737.1 million for 2018. Our operating margin for the prior-year period, reflecting growth in each of our operating segments and additional revenues from acquired businesses, despiteyear ended December 31, 2019 was 16.1%, compared to 21.9% for the unfavorable effect of fluctuations in foreign currency exchange rates of $35.3 million.year ended December 31, 2018.

Net income attributable to Global Payments was $124.9$430.6 million for the 2016 fiscal transition periodyear ended December 31, 2019 compared to $194.8$452.1 million for the prior-year period, reflecting additional intangible amortization expenses of $145.6 million associated with recently acquired businesses, integration expenses associated with our merger with Heartland Payment Systems, Inc., or Heartland, of $91.6 million2018, and the unfavorable effect of fluctuations in foreign currency. Diluteddiluted earnings per share were $0.81was $2.16 for the 2016 fiscal transition periodyear ended December 31, 2019 compared to $1.49$2.84 for the prior-year period.2018.

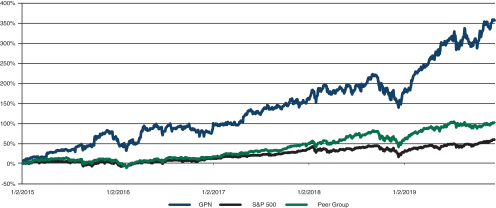

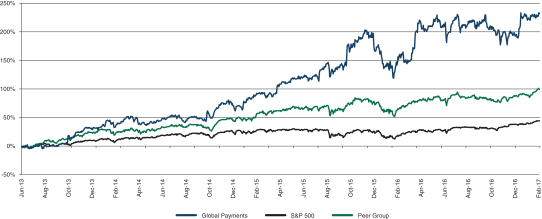

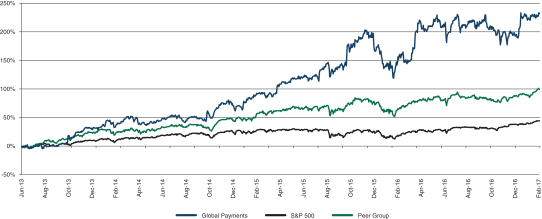

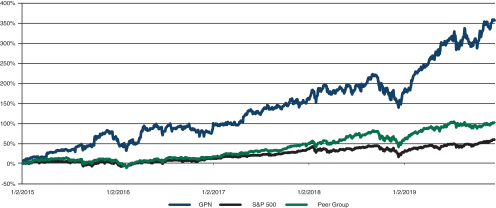

Total Shareholder Return vs. S&P 500 Index/Peer Company Average

2 – GLOBAL PAYMENTS INC. |2020 Proxy Statement

Board and Corporate Governance Highlights

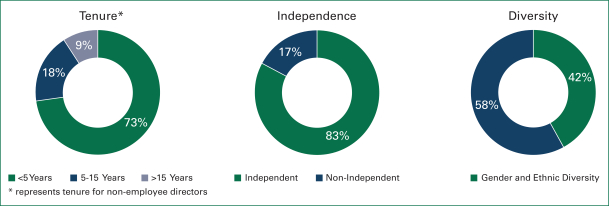

We have adopted leading governance practices that establish strong independent leadership in our boardroom and provide our shareholders with meaningful rights.

Corporate governance highlights include:

| ☑ | Lead Independent Director |

| ☑ | Eleven out of twelve directors arenon-employees |

| ☑ | Ten out of twelve directors are independent |

| ☑ | Five out of twelve directors are diverse in gender and/or ethnicity |

| ☑ | Annual election of directors |

| ☑ | Fully independent Audit, Compensation, and Governance and Nominating Committees |

| ☑ | Annual board and committee self-evaluations |

| ☑ | Proxy access for shareholders |

| ☑ | Majority voting for directors in uncontested elections |

| ☑ | Minimum stock ownership requirements for NEOs and directors (increased holding requirements for 2020) |

| ☑ | Limitations on outside board and audit committee service |

| ☑ | Greater than 75% director attendance at meetings |

| ☑ | Non-employee directors meet without management present |

| ☑ | Independent directors meet withoutnon-independent directors present |

| ☑ | Code of business conduct and ethics for directors |

The board has taken a thoughtful and deliberate approach to board composition to ensure that our directors have backgrounds that collectively add significant value to the strategic decisions made by the Company and enable them to provide oversight of management to ensure accountability to our shareholders. In connection with the merger with TSYS, we increased the size of our board to twelve directors, six of whom were individuals designated by Global Payments, consisting of five independent directors of Global Payments and our Chief Executive Officer, and the remaining six designated by TSYS, consisting of five independent directors and TSYS’ former Chief Executive Officer. The newly constituted board includes five members who are diverse in gender and/or ethnicity.

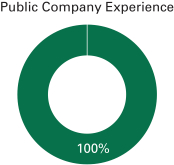

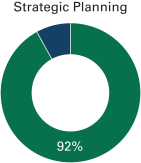

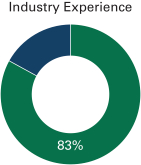

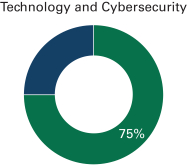

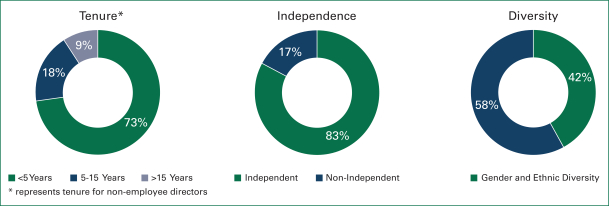

The composition of our board consists of:

GLOBAL PAYMENTS INC. | 20172020 Proxy Statement – 13

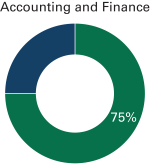

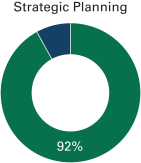

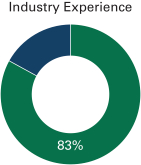

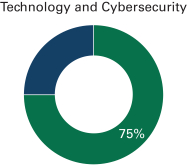

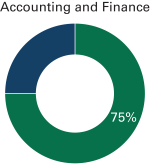

The board has identified the following key qualifications and experience that are important to be represented on the board as a whole in light of our current business strategy and expected needs. The charts below indicate how these qualifications are represented on our board. Information regarding each director’s skills and qualifications can be found within their individual biographies on pages 15-20.

|  |  |

|  | ||||||

|  |  |

| indicates board representation of the qualification |

The following graph comparesWe believe in providing transparent and timely information to our investors. Our senior management, including our Chief Executive Officer, President and Chief Operating Offer, and Chief Financial Officer, routinely provide information to and receive feedback from our investors in a wide variety of formats, including in our quarterly SEC filings, quarterly earnings conference calls, our Annual Report and proxy statement, regular investor conferences and roadshows, and meetings with individual investors. We have a staff of professionals in our Investor Relations department who are dedicated full time to respond to questions from shareholders and other investors about the cumulative shareholder returns of $100 invested in the S&P 500 Index, our Company and the averageits performance.

4 – GLOBAL PAYMENTS INC. |2020 Proxy Statement

2019 Outreach

During 2019, we held meetings with many of our top institutional investors, during which we discussed a variety of topics that are important to investors, including industry trends, environmental, social and governance, or ESG, matters, Company performance peer groupand operations, and short and long-term strategic direction.

In 2019, we also conducted an expansive shareholder outreach program to gauge support for our executive compensation practices and corporate governance policies and to respond to shareholder input. Accordingly, our management, together with the Chairman of our Compensation Committee, engaged with twenty of our top twenty-four shareholders, including both active and passive investors, representing approximately 65% of our total shares outstanding, on the Company’s executive compensation program. The feedback we received from June 1, 2013 through February 28, 2017, assuming reinvestmentshareholders regarding our executive compensation program was positive, and the vast majority of dividends.

The graph excludes peer group performance for PayPal, Inc.shareholders voted in favor of our program. After evaluating the outcome of the 2019 advisory vote, shareholder feedback and First Data Corp., because these two companies wereinput from our independent compensation consultant, the Compensation Committee determined that our executive compensation programs are aligned with our compensation philosophy and the Company strategy and decided not publicly traded forto make any material changes to the full period presented above.structure or principles of the program. Importantly, the general shareholder feedback we received indicated that our investors did not have significant issues with either our executive compensation program or the compensation mix of our Chief Executive Officer or any of our other officers.

Recent Corporate Governance Highlights (Page 13)Developments

As a result of engaging with our shareholders and keeping abreast of leading practices, we have taken actions with respect to corporate governance matters, including the following:

Declassified our board and implemented annual election of directors.

Appointed a lead independent director of the board.

Established a number of diversity initiatives to increase representation of diverse individuals in the Company and support and elevate our diverse employees, and enhanced our proxy disclosure with respect to such practices.

Issued our Global Responsibility Report.

Proposing at this annual meeting the amendments to our Articles of Incorporation to eliminate the supermajority voting requirements.

GLOBAL PAYMENTS INC. |2020 Proxy Statement– 5

Environmental Sustainability

We are committed to having a positive impact in the markets we serve and communities in which our employees live and work. In 2019, we issued our Global Responsibility Report, which details our recent achievements and initiatives to drive positive change across four pillars, Culture and Values, Environmental Sustainability, Community Impact and Corporate Responsibility. Our board of directors values independent, effective and ethical corporate governance. HighlightsGlobal Responsibility Report (which is not incorporated into this proxy statement) can be found in the Investor Relations section of our corporate governance structure includewebsite athttps://investors.globalpaymentsinc.com. The following are some highlights of our environmental sustainability program:

Focusing on the following:Environment:

|

We are committed to enhancing energy efficiency across our facilities, including supporting renewable energy initiatives. It is our practice to procure new space in

| |

| Managing Waste: We have implemented recycling initiatives to limit what we send to landfills and have a formal destruction of data policy to minimize e-waste. In all of our larger offices, our physical recycling policies extend to plastics and glass, and we are in the process of implementing a no Styrofoam initiative globally. | |

| Data Space Initiaties In the U.S., we are actively working to consolidate our data space footprint and are committed to evaluating the environmental impact and green efforts of the facilities where we lease storage capacity. Our largest data centers, which account for the majority of our domestic storage, have a number of green initiatives in place, including renewable power systems and rainwater harvesting and reclamation programs. We are also looking for new and innovative ways to reduce the impact our data has on the environment, which we are increasingly accomplishing through our move to the cloud. | |

| Providing Alternative Transportation: As part of our effort to reduce our carbon footprint, all of our U.S. and a majority of our international offices are located close to public transit. | |

Our Company has always prided itself on inclusiveness and embraces the diversity of its employees in all of our geographic regions. We currently do business in over 100 countries in North America, Europe, the Asia-Pacific region and Latin America, with employees living and working in 38 different countries. We believe that our business is strengthened by a diverse workforce that reflects the communities in which we operate.

In 2018 and continuing in 2019, we built on our history of diversity and inclusion by formally launching a diversity and inclusion initiative, which included establishing a Diversity and Inclusion Advisory Council chaired by our President and Chief Operating Officer and consisting of a representative group of our employees. As part of this initiative, we became a signatory to the CEO Action for Diversity and Inclusion™, which is the largestCEO-driven business commitment to advance diversity and inclusion in the workplace.

6 – GLOBAL PAYMENTS INC. |2020 Proxy Statement

In 2019, we took the following actions with respect to our diversity and inclusion practices:

• Expanded the Global Payments Women’s Network, an employee resource group which implements diversity initiatives related to women, including networking and training opportunities. • Launched the Global Payments Pride Network, an LGBTQIA employee resource group chaired by our General Counsel. | ||||

• Received a 100 percent score on the Human Rights Campaign Foundation’s 2019 Corporate Equality Index™,which is the national benchmarking tool on corporate policies and practices pertinent to the LGBTQIA employees. • Launched the Global Payments Veterans Network, chaired by our Chief Financial Officer, which is committed to increasing veteran inclusion and hiring, and provides volunteer opportunities for Company employees to support veteran-related organization and events. • Launched our Inclusion and Diversity speaker series as an information resource for all employees around the world. • Committed to providing unconscious bias training beginning in 2019 to all of our executives and people managers. • Developed a recruitment strategy with the goal of attracting employees of diverse backgrounds. |

In addition, we believe it is important that the makeup of our board reflects our commitment to diversity and inclusion and are proud that five of the twelve members of our board are diverse in gender or ethnicity. We will continue to measure our progress to ensure our initiatives and programs continue to support our diversity and inclusion goals.

Compensation Philosophy and Highlights (Page 27)

We Do: | We Do Not: | |

☑ Tie pay to financial and share price performance | ||

☑ Retain an independent compensation consultant ☑ Benchmark against our peer group ☑ Conduct an annualsay-on-pay vote ☑ Adjust performance goals under our short-term incentive plan to reflect acquisition impacts ☑ Require Compensation Committee certification of performance results for purposes of NEOs’ compensation ☑ Employ “double-trigger”change-in-control compensation ☑ Have a clawback policy ☑ Impose minimum stock ownership thresholds and holding periods until such thresholds are met | ☒ Provide for excise taxgross-ups ☒ Permit hedging or pledging of our stock | |

| ☒ Re-price or discount stock options or SARs | |

| ☒ Permit liberal share recycling or “net share counting” upon exercise of stock options or SARs ☒ Pay dividend equivalent rights on | |

| ||

| ||

| ||

| ||

2 –GLOBAL PAYMENTS INC. | 20172020 Proxy Statement– 7

Core Component | Page | |||||||||

| Base Salary | Base salaries are intended to provide compensation consistent with our | 44

| |||||||

| Annual Cash Incentives | Our annual performance plan rewards short-term Company performance, while aligning the interests of our

| ||||||||

| Performance Units |

Performance units are performance-based restricted stock units that, after a Performance units are

| ||||||||

Stock Options | Stock options

| |||||||||

Restricted Stock |

Restricted stock granted as part of our annual compensation program | 48

| ||||||||

GLOBAL PAYMENTS INC. |2017 Proxy Statement– 32019 Compensation Highlights

The following charts show the mix of total target compensation in 2019 (reflecting the new compensation targets for base salary and short-term cash incentive set upon completion of the merger with TSYS) for our Chief Executive Officer and for allthe average of the other named executive officers as a group, based on a weighted average,NEOs, as well as the portion of that compensation that is subject to forfeiture (“at risk”) or performance-based (exclusive of one-time synergy units granted during the 2016 fiscal transition period).performance-based.

CEO TOTAL TARGET COMPENSATION | OTHER NEOs TOTAL TARGET | |

|

|

| * | Excludes Mr. Todd, who joined the Company on September 18, 2019. |

8 – GLOBAL PAYMENTS INC. |2020 Proxy Statement

Name | Tenure | Principal Occupation | Non- Employee | Audit Committee | Compensation Committee | Governance and Nominating Committee | Technology Committee | ||||||||||||||||||||||||

|

|

| |||||||||||||||||||||||||||||

| Yes |  | |||||||||||||||||||||||||||||

| Kriss Cloninger III |  | ||||||||||||||||||||||||||||||

| Former President, Aflac Inc. | Yes |

| |||||||||||||||||||||||||||||

| 6 Years | Chief Executive Officer, Global Payments Inc. | No | |||||||||||||||||||||||||||||

| F. Thaddeus Arroyo | 6 Months | Chief Executive Officer, AT&T Consumer | Yes |

| |||||||||||||||||||||||||||

| Robert H.B. Baldwin, Jr. | 4 Years | Former Vice Chairman, Heartland Payment Systems, Inc. | Yes |

| |||||||||||||||||||||||||||

| John G. Bruno | 6 Years | Chief Operating Officer, Aon, plc | Yes |

|

| ||||||||||||||||||||||||||

| William | 19 Years | Chairman and Interim CEO of Green Dot Corp. | Yes |

|

| ||||||||||||||||||||||||||

| Joia M. Johnson | 6 Months | Chief Administrative Officer, Hanesbrands Inc. | Yes |

|

| ||||||||||||||||||||||||||

| Ruth Ann Marshall | 14 Years | Former President of Americas, MasterCard International | Yes |

|

| ||||||||||||||||||||||||||

| Connie D. McDaniel | 6 Months | Director, Virtus Mutual Fund Family | Yes |

|

| ||||||||||||||||||||||||||

| William B. Plummer | 3 Years | Former Executive Vice President | Yes |

| |||||||||||||||||||||||||||

| John T. Turner | 6 Months | Chairman of the Board, W.C. Bradley Co. | Yes |

|

| ||||||||||||||||||||||||||

|

Beginning on page 26,52, we provide specific data about the compensation of our “named executive officers,”NEOs as defined by rules promulgated by the Securities and Exchange Commission, or the SEC, for 2019. Our NEOs for the 2016 fiscal transition period. Our named executive officers include the following individuals:year ended December 31, 2019 were:

Jeffrey S. Sloan, Chief Executive Officer

Cameron M. Bready, President and Chief Operating Officer (and former Chief Financial Officer)

Paul M. Bready,Todd, Senior Executive Vice President and Chief Financial Officer

Dr. Guido F. Sacchi, Senior Executive Vice President and Chief Information Officer

David L. Green, Senior Executive Vice President, General Counsel and Corporate Secretary

4 –GLOBAL PAYMENTS INC. | 20172020 Proxy Statement– 9

Questions and Answers About Our Annual Meeting and this Proxy Statement

1. Why did I receive these materials?

This proxy statement is being furnished to solicit proxies on behalf of the board of directors of our Company for use at the 20172020 annual meeting of shareholders and at any adjournments or postponements thereof. The annual meeting will be held at our offices at 3550 Lenox Road, Atlanta, Georgia, 3032130326 on Wednesday, May 3, 2017April 29, 2020 at 9:30 a.m., Eastern Daylight Time.

2. What am I voting on and how does the board of directors recommend that I vote?

Our board of directors recommends that you voteFOR each of the following four proposals scheduled to be voted on at the meeting:

| • | Proposal 1: Election of each of the |

| • | Proposal 2: Approval, on an advisory basis, of the compensation of |

| • | Proposal 3: Approval of amendments to |

| • | Proposal 4: Ratification of the reappointment of Deloitte as our independent public accounting firm for the year ending December 31, |

3. Could other matters be decided at the annual meeting?

Yes. The shareholders may transact any other business that may properly come before the annual meeting or any adjournments or postponements thereof. If any other matter properly comes before the meeting and you have submitted your proxy, the proxy holders will vote as recommended by the board or, if no recommendation is made, in their own discretion.

4. Why did I receive a mailed notice of internet availability of proxy materials instead of a full set of proxy materials?

As permitted by the SEC, we are making this proxy statement and our TransitionAnnual Report on Form10-K available to our shareholders electronically via the internet. The notice contains instructions on how to access this proxy statement and our TransitionAnnual Report on Form10-K and how to vote online or submit your proxy over the internet or by telephone. You will not receive a printed copy of the proxy materials in the mail unless you request one, which you may do by following the instructions contained in the notice. We encourage you to take advantage of the electronic availability of proxy materials to help reduce the cost and environmental impact of the annual meeting.

5. How do I vote?

If you received a notice of electronic availability, that notice provides instructions on how to vote by internet, by telephone or by requesting and returning a paper proxy card. You may submit your proxy voting instructions via the internet or telephone by following the instructions provided in the notice. The internet and telephone voting procedures are designed to authenticate your identity, to allow you to vote your shares, and to confirm that your voting instructions are properly recorded. If your shares are held in the name of a bank or a broker, the availability of internet and telephone voting will depend on the voting processes of the bank or broker. Therefore, we recommend that you follow the instructions on the form you receive. If you received a printed version of the proxy materials by mail, you may vote by following the instructions provided with your proxy materials and on your proxy card.

10 –GLOBAL PAYMENTS INC. | 20172020 Proxy Statement– 5

6. What if I change my mind after I vote?

Your submission of a proxy via the internet, by telephone or by mail does not affect your right to attend the annual meeting in person. You may revoke your proxy at any time before it is exercised in any of the following ways:

Deliver written notice of revocation to our Corporate Secretary at 10 Glenlake Parkway, North Tower,3550 Lenox Road, Suite 3000, Atlanta, Georgia 30328-3473,30326, or submit to us a duly executed proxy card bearing a later date. To be effective, your notice of revocation or new proxy card must be received by our Corporate Secretary, David L. Green, at or before the annual meeting.

Change your vote via the internet or by telephone at a later date. To be effective, your vote must be received before 11:59 p.m., Eastern Daylight Time, on May 2, 2017,April 28, 2020, the day before the annual meeting.

Appear at the annual meeting and vote in person, regardless of whether you previously submitted a notice of revocation.

7. Who is entitled to vote?

All shareholders who owned shares of our common stock at the close of business on March 3, 20176, 2020 are entitled to vote at the annual meeting. On that date, there were 152,491,982 shares of common stock issued and outstanding, held by approximately 2,180 shareholders of record. Shareholders are entitled to one vote per share.

8. How many votes must be present to hold the annual meeting?

In order for any business to be conducted, the holders of a majority of the shares entitled to vote at the annual meeting must be present, either in person or by proxy. This is referred to as a “quorum.” Abstentions and brokernon-votes (described below) will be treated as present for purposes of establishing a quorum. If a quorum is not present, the annual meeting may be adjourned by the holders of a majority of the shares represented at the annual meeting. The annual meeting may be rescheduled at the time of the adjournment with no further notice of the reconvened meeting if the date, time and place of the reconvened meeting are announced at the adjourned meeting before its adjournment; provided, however, that if a new record date is or must be fixed, notice of the reconvened meeting must be given to the shareholders of record as of the new record date. An adjournment will have no effect on the business to be conducted at the meeting.

9. What are the voting standards for the proposals?

EachProposal 1: Election of directors. Election of the four scheduled proposals will be approved12 directors nominated by our board requires the affirmative vote of a majority of the votes cast. ThisThat means that athis proposal is approved if the number of shares voted “for” the proposal exceeds the number of shares voted “against” the proposal.

Proposal 2:Say-on-pay. Approval, on an advisory basis, of the compensation of the NEOs for 2019 requires the affirmative vote of a majority of the votes cast. That means that this proposal is approved if the number of shares voted “for” the proposal exceeds the number of shares voted “against” the proposal.

Proposal 3: Elimination of supermajority voting requirements. Approval of the amendments to our Articles of Incorporation to eliminate the supermajority voting requirements requires the affirmative vote of holders of a majority of our issued and outstanding shares of common stock as of March 6, 2020.

Proposal 4: Independent public accounting firm. Approval of the ratification of the reappointment of Deloitte as our independent public accounting firm for the year ending December 31, 2020 requires the affirmative vote of a majority of the votes cast. That means that this proposal is approved if the number of shares voted “for” the proposal exceeds the number of shares voted “against” the proposal.

GLOBAL PAYMENTS INC. |2020 Proxy Statement– 11

10. What is the difference between a “shareholder of record” and a “beneficial owner of shares held in street name?”

Shareholders of record. If your shares are registered directly in your name with our transfer agent, Computershare, you are the shareholder of record with respect to those shares, and we sent the notice of electronic availability directly to you. If you request copies of the proxy materials by mail, you will receive a proxy card.

Beneficial owners of shares held in street name. If your shares are held in an account at a brokerage firm, bank, broker-dealer or other similar organization, then you are the beneficial owner of shares held in “street name,” and the notice of electronic availability was forwarded to you by that organization. The organization holding your account is considered the shareholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct that organization on how to vote the shares held in your account. If you request copies of the proxy materials by mail, you will receive a voting instruction form.

6 – GLOBAL PAYMENTS INC. |2017 Proxy Statement

11. What happens if I do not return a proxy or do not give specific voting instructions?

Shareholders of record.record. If you are a shareholder of record and you do not vote via the internet, by telephone or by mail, your shares will not be voted unless you attend the annual meeting to vote them in person. If you are a shareholder of record and you sign and return a proxy card without giving specific voting instructions, then your shares will be voted in the manner recommended by the board of directors on all matters presented in this proxy statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the annual meeting.

Beneficial owners of shares held in street name.name. If you hold your shares in street name and do not provide voting instructions to your broker, your broker will have the discretionary authority to vote your shares only on proposals that are considered “routine.” The only proposal at the annual meeting that is considered routine is the ratification of the reappointment of our independent auditor.registered public accounting firm. All of the other proposals are considered“non-routine,” which means that your broker will not have the discretionary authority to vote your shares with respect to such proposals. Shares for which you do not provide voting instructions and a broker lacks discretionary voting authority are referred to as “brokernon-votes.” Brokernon-votes are counted as present for the purpose of establishing a quorum, but whether they are counted for purpose of voting on proposals depends on the voting standard for the particular proposal. Since each of the scheduled proposals requires approval by a majority of votes cast, abstentions

Abstentions andbroker non-votes will not be counted have the same effect as votes “for” ora vote “against” the proposal. As a result, although abstentionsproposal to amend the Articles of Incorporation and broker non-votes may be counted for the purpose of establishing a quorum for the meeting, theywill have no effect on the voting results.outcome of the vote tore-elect directors, approve the advisory vote on the compensation of the NEOs or ratify the appointment of Deloitte.

12. What should I do if I receive more than one proxy or voting instruction card?

Shareholders may receive more than one set of voting materials, including multiple copies of the notice of electronic availability, these proxy materials and proxy cards or voting instruction cards. For example, shareholders who hold shares in more than one brokerage account may receive separate notices for each brokerage account in which shares are held. Shareholders of record whose shares are registered in more than one name will receive more than one notice. You should vote in accordance with all of the notices you receive to ensure that all of your shares are counted.

13. Who pays the cost of proxy solicitation?

The cost of soliciting proxies will be borne by us. However, shareholders voting electronically (via phone or the internet) should understand that there may be costs associated with electronic access, such as usage charges from internet service providers or telephone companies. In addition to solicitation of shareholders of record by mail, telephone or personal contact, arrangements will be made with brokerage houses to furnish proxy materials to their principals, and we may reimburse them for mailing expenses. Custodians and fiduciaries will be supplied with proxy materials to forward to beneficial owners of common stock.

12 – GLOBAL PAYMENTS INC. |2020 Proxy Statement

14. May I propose actions for consideration at next year’s annual shareholder meeting?

Yes.Proposals for Inclusion in Next Year’s Proxy Statement (Rule14a-8): SEC rules establish the eligibility requirements and the procedures that must be followedpermit shareholders to submit proposals for a shareholder’s proposal to be includedinclusion in our proxy statement. Under those rules, anystatement if the shareholder wishing to have aand the proposal consideredmeet the requirements specified in Rule14a-8 of the Securities Exchange Act of 1934, or the Exchange Act. Proposals submitted in accordance with Rule14a-8 for inclusion in our proxy statement for the 20182021 annual shareholder meeting must submit his or her proposal to us in writing on or before November 21, 2017,be received by our Corporate Secretary no earlier than , 2020 and no later than , 2020, which is 120 days before the one year anniversary of the mailing of this proxy statement. Proposals must comply with all applicable SEC rules and our bylaws. In addition, if

Director Nominees for Inclusion in Next Year’s Proxy Statement (Proxy Access): Our bylaws permit a shareholder wishes(or a group of no more than 20 shareholders) owning 3% or more of our common stock continuously for at least three years to present a proposal atnominate up to an aggregate limit of two candidates or 20% of our board (whichever is greater) for inclusion in our proxy statement. Notice of such nominees must be received no earlier than , 2020 and no later than close of business on , 2020.

Other Business Proposals/Director Nominees: Our bylaws also set forth the 2018 annual meeting, whether or not the proposal is intended to be included in the 2018 proxy material, our bylaws requireprocedures that the shareholder give advance written notice to us on or after October 22, 2017 and on or before November 21, 2017. A shareholder may be permitted to present a proposal at the 2018 annual meeting, even if the proposal was not included in the 2018 proxy material. In such a case, if the proposal is received after February 4, 2018, which is 45 calendar days prior to the one year anniversary of the mailing of this proxy statement, we believe that the proxy holder would have the discretionary authority granted by the proxy cards (and as permitted under SEC rules) to vote on the proposal on behalf of the shareholders who submitted the proxies.

GLOBAL PAYMENTS INC. |2017 Proxy Statement– 7

If a shareholder wishes for the Governance and Nominating Committeemust follow to considernominate a candidate for election as a director recommendedor to propose other business for consideration at shareholder meetings, in each case, not submitted for inclusion in next year’s proxy statement (either under proxy access or Rule14a-8), but instead to be presented directly at shareholder meetings. In each case, director nominations or proposals for other business for consideration at the 2021 annual shareholder meeting submitted under these bylaw provisions must be received by our Corporate Secretary between , 2020 and , 2020. Special notice provisions apply under the shareholder for nomination tobylaws if the date of the annual meeting is more than 30 days before or 60 days after the anniversary date.

Our Corporate Secretary address is: 3550 Lenox Road, Suite 3000, Atlanta, GA 30326. Notice must include the information required by our board of directors, the shareholder must submit the recommendationbylaws, which are available without charge upon written request to our Corporate Secretary at our corporate offices in accordance with the procedures described above. In addition, our bylaws require that, among other things, all shareholder recommendations for director candidates must be in writing and must set forth the shareholder’s name, address and other contact information as well as the following information about the recommended candidate: (i) name, date of birth, business address and residential address, (ii) a complete description of the candidate’s qualifications, experience, background and affiliations, as would be required to be disclosed in the proxy statement pursuant to Schedule 14A under the Securities Exchange Act of 1934, as amended, or the Exchange Act; (iii) a sworn or certified statement by the candidate in which he or she consents to being named in the proxy statement as a nominee and to serve as director if elected, and (iv) a written statement from the shareholder making the recommendation stating why such recommended candidate meets the criteria and would be able to fulfill the duties of a director.Secretary.

Cautionary Note Regarding Forward-Looking Statements

This proxy statement contains forward-looking statements as defined in the Exchange Act and is subject to the safe harbors created therein. The forward-looking statements contained herein are generally identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” “committed,” “ensure,” or the negative of these terms or other similar expressions. Forward-looking statements are based on the beliefs and assumptions of our management and on currently available information. Accordingly, our future plans and expectations may not be achieved and our results could differ materially from those anticipated in our forward-looking statements as a result of many known and unknown factors, many of which are beyond our ability to predict or control. A detailed discussion of risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in our TransitionAnnual Report on Form10-K. We undertake no responsibility to publicly update or revise any forward-looking statement.

8 –GLOBAL PAYMENTS INC. | 20172020 Proxy Statement– 13

Proposal One: Election of Directors

Our board of directors, upon the recommendation of the Governance and Nominating Committee, has nominated directors John G. Bruno, Jeffrey S. Sloanthe individuals identified on the following pages for election as directors. Each nominee is currently a director of Global Payments. The board believes that the qualifications and William B. Plummer,experience of the director nominees, as described below, will continue to contribute to an effective and well-functioning board. For information on the factors the board considers when evaluating candidates for nomination, see “Board and Corporate Governance — Board Membership Criteria” on page 22.

If elected, each a Class II director, to be electednominee will continue to serve as a director until the 2020 annual meetingCompany’s 2021 Annual Meeting of shareholders andShareholders or until their successors arehis or her successor is duly elected and qualified.qualified or he or she resigns or is otherwise removed. Each nominee has agreed to serve as a director if elected.

Our board of directors currently consists of ten members who are divided into three classes,In connection with our merger with TSYS, we amended our bylaws to provide that until the term of office of each class ending in successive years. Each class of directors serves staggered three-year terms. Michael W. Trapp, a Class II director will not stand for re-election at the 20172022 annual meeting of shareholders, due to director age limitations under our corporate governance guidelines. Effective asthe number of March 6, 2017, our board appointed a new director, William B. Plummer, who is standing for election at this annual meeting.

The composition of ourdirectors that comprises the entire board of directors will be twelve, unless changed by the affirmative vote of at least 75% of the board. Until the 2022 annual meeting of shareholders, no vacancy on the board created by the resignation, retirement, disqualification, removal from office or death of a director will be filled by the board, and the board will not nominate any individual to fill such vacancy, unless, in the case of a vacancy created by a continuing Global Payments director, not less than a majority of the continuing Global Payments directors then in office have approved the appointment or nomination (as applicable) to fill such vacancy and, in the case of a vacancy created by a continuing TSYS director, not less than a majority of the continuing TSYS directors then in office have approved the appointment or nomination (as applicable) to fill such vacancy.

Election Process

The Company has a majority voting standard to elect directors in uncontested elections of directors, such as this election. Under the majority voting standard, a nominee must receive a greater number of votes “FOR” than “AGAINST” his or her election. If an uncontested nominee who is currentlyalready a director receives more “AGAINST” votes than “FOR” votes, that director will continue to serve as follows:a “holdover director,” but is required to tender his or her resignation to the board. If the tendered resignation does not expressly require acceptance by the board, the resignation will become effective immediately, or upon the date set forth in the resignation, and there will be a vacancy on the board upon the effective date of the resignation. If the tendered resignation specifies that it is not effective until accepted by the board, the board has the discretion to accept or reject the resignation. In such a case, the Governance and Nominating Committee will promptly consider the tendered resignation and recommend to the board whether to accept or reject the tendered resignation. The Company will publicly disclose the board’s decision within 90 days from the date of the certification of the election results.

Class I | Class II | Class III | ||||||||

Name | Term Expiration | Name | Term Expiration | Name | Term Expiration | |||||

Mitchell L. Hollin* | 2019 | John G. Bruno* | 2017 | Robert H.B. Baldwin, Jr. | 2018 | |||||

Ruth Ann Marshall* | 2019 | Jeffrey S. Sloan | 2017 | William I Jacobs* | 2018 | |||||

John M. Partridge* | 2019 | William B. Plummer* | 2017 | Alan M. Silberstein* | 2018 | |||||

| Michael W. Trapp*(1) | 2017 | |||||||||

In each case, the director nominee, if elected, will serve a shorter term in the event of his or her resignation, retirement, disqualification, or removal from office or death. In the event that any of the nominees is unable to serve (which is not anticipated), the persons designated as proxies will cast votes for such other person(s) as they may select.select, subject to the guidelines set forth above. The affirmative vote of at least a majority of the votes cast with respect to the director nominee at the annual meeting at which a quorum is present is required for the election of each of the nominees. If a choice is specified on the proxy card by a shareholder, the shares will be voted as specified. If no specification is made, the shares will be voted “FOR” each of the threetwelve nominees.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE

“FOR” “FOR” THE ELECTION OF ALL OF THE NOMINEES FOR DIRECTOR.

14 – GLOBAL PAYMENTS INC. |2020 Proxy Statement

Director Nominee Biographies

M. Troy Woods • Chairman since 2019 • Age 68 | Skills and Qualifications: Mr. Woods’ qualifications to serve on the board include his extensive knowledge of TSYS’ business and the payments and technology industry gained through his more than 30 years’ experience at TSYS. In addition, Mr. Woods has valuable leadership and risk management skills and extensive experience in and knowledge of the payment services and financial services industries. Prior to its merger with Global Payments in 2019, Mr. Woods served as Chairman, President and Chief Executive Officer of TSYS (July 2014 — September 2019); President and Chief Operating Officer of TSYS (December 2003 — July 2014); Executive Vice President of TSYS (1995 — 2003); Vice President of TSYS (1987 — 1995); Senior Vice President of Consumer Lending of AmSouth Bank (1982 — 1987); Senior Vice President for Card Services of United American Bank (1977 — 1979). | |

Kriss Cloninger III • Lead Independent Director • Independent director since 2019 • Compensation Committee • Age 72 | Skills and Qualifications: Mr. Cloninger’s qualifications to serve on the board include his leadership skills, risk management experience, expertise in corporate strategy development, and experience as both the president and a principal financial officer of a public company with a strong international business. Mr. Cloninger served as the President and member of the board of directors (2001 — 2017), and Chief Financial Officer (1992 — 2015) of Aflac Incorporated, an insurance holding company; and prior to that as Principal with KPMG LLP. Mr. Cloninger serves as a director of Tupperware Brands Corporation and is Chair of its Compensation Committee. He served on the board of TSYS from 2004 and as lead independent director of TSYS from 2017 until the closing of the company’s merger with Global Payments in September 2019. |

GLOBAL PAYMENTS INC. | 20172020 Proxy Statement – 915

Nominees for Election as Directors

Biographical and other information about each director nominated for election is set forth below:

Jeffrey S. Sloan

•

•

• | Skills and Qualifications: Mr. Sloan’s qualifications to serve on the board include his more than 26 years of experience in Mr. Sloan has served as Chief Executive Officer of the Company (since October 2013); President of the Company (June 2010 — June 2014); Partner, Goldman Sachs Group, Inc. (2004 — May 2010), where Mr. Sloan led the Financial Technology Group in New York and focused on mergers, acquisitions and corporate finance; Managing Director, Goldman Sachs Group, Inc. (2001 — 2004); Vice President, Goldman Sachs Group, Inc. (1998 — 2001); Director, FleetCor Technologies, Inc., a publicly-traded provider of fuel cards and workforce payment products and services (since July 2013). | |

F. Thaddeus Arroyo

•

• Technology Committee (Chair)

• Age | Skills and Qualifications: Mr. Arroyo’s qualifications to serve on the board include his experience in innovation, cyber-security and global business experience and mergers and acquisitions, in addition to his leadership skills and ability to manage technology innovation projects as he has done in various roles at AT&T. Mr. Arroyo serves as the Chief Executive Officer of AT&T Consumer Business (since September 2019). He previously served as Chief Executive Officer of AT&T Business (2017 — September 2019); CEO of AT&T Mexico, LLC (January 2015 — December 2016); President-Technology Development of AT&T (September 2014 — January 2015); Chief Information Officer of AT&T (2007 — 2014); CIO at Cingular Wireless (2001 — 2007) and in various capacities with Sabre Inc. (1992 — 2001), including Senior Vice President of Product Marketing and Development. |

16 – GLOBAL PAYMENTS INC. |2020 Proxy Statement

Robert H.B. Baldwin, Jr. • Independent Director since April 2019 • Director since April 2016 • Audit Committee • Age 65 | Skills and Qualifications: Mr. Baldwin’s qualifications to serve on the board include his financial and industry experience, andin-depth knowledge of our business gained from his 16 years of service as a member of Heartland’s executive management team, as well as his many contributions to the growth and success of Heartland during his tenure. Mr. Baldwin has served as Vice Chairman (an executive office), Heartland (June 2012 — April 2016); Interim Chief Financial Officer, Heartland (October 2013 — April 2014); President, Heartland (2007 — June 2012); Chief Financial Officer, Heartland and its predecessor, Heartland Payment Systems LLC (2000 — 2011); Chief Financial Officer, COMFORCE Corp., a publicly-traded staffing company (1998 — 2000); Managing Director, financial institutions advisory business of Smith Barney (1985 — 1998); Vice President, Citicorp (1980 — 1985). Mr. Baldwin currently serves as director of Boomtown Network, Inc., a private company that provides intelligent software and services (since May 2019). | |

John G. Bruno • Independent Director since June 2014 • Compensation Committee (Chair) • Technology Committee • Age 55 | Skills and Qualifications: Mr. Bruno’s qualifications to serve on the board include his extensive executive leadership experience with technology, cyber-security and payments-related matters within the financial services industry through his prior position as Chief Information Officer, and current position as Chief Operations Officer, of Aon, plc, and his service in executive roles at NCR Corporation and Symbol Technologies, Inc. Mr. Bruno has served as Chief Operating Officer (since February 2020), Chief Executive Officer, Data and Analytic Services, and member of the Executive Committee of Aon, plc, a publicly-traded global risk management service provider (since April 2017); Chief Operations Officer (April 2017 — February 2020); Executive Vice President of Enterprise Innovation and Chief Information Officer, Aon, plc | |

| ||

|

10 –GLOBAL PAYMENTS INC. | 20172020 Proxy Statement– 17

Biographical information with respect to our other directors is set forth below:

William I Jacobs

•

• Compensation Committee

• Governance and Nominating Committee

• Age | Skills and Qualifications: Mr. Jacobs’ qualifications to serve on the board include his extensive executive management experience, leadership skills demonstrated throughout his16-year tenure as our Chairman of the board or lead director, board expertise and legal training. The Board believes Mr. Jacobs will continue to provide leadership and consensus building skills on matters of strategic importance. Through his tenure on our board, Mr. Jacobs has acquired an unmatchable breadth of knowledge and understanding of our business, which allows him to offer a unique perspective on the Company’s strategies and operations. Mr. Jacobs served as Chairman of the Company’s | |

• Independent

| ||

• Technology Committee

• Compensation Committee • Age | Skills and Qualifications: Ms. Johnson’s qualifications to serve on the board include her global leadership experience over several corporate functions for publicly traded companies including legal, human resources, corporate social responsibility, government and trade relations, real estate, and corporate security and her domestic and global mergers and acquisitions experience. Ms. Johnson has served as the Chief Administrative Officer of Hanesbrands Inc., |

18 –GLOBAL PAYMENTS INC. | 20172020 Proxy Statement– 11

Ruth Ann Marshall

•

•

• Governance and Nominating Committee

• Age | Skills and Qualifications: Ms. Marshall’s qualifications to serve on the board include her deep knowledge of our business and industry, having served, among other roles, as President, Americas for Ms. Marshall has served as President, Americas for Mastercard International (2000 — 2006) |

• Independent

•

• Audit Committee

•

| Skills and Qualifications: Ms. McDaniel’s qualifications to Ms. McDaniel serves as a director of the Virtus Mutual Fund Family (since 2017) and as an audit committee member of the Virtus Closed End Funds board, which includes the Duff & Phelps Select MLP & Midstream Energy Fund, Inc. |

GLOBAL PAYMENTS INC. |2020 Proxy Statement– 19

• Independent

•

•

| Skills and Qualifications: Mr. Plummer’s qualifications to serve on the board include his executive leadership experience, including his service as the Chief Financial Officer of United Rentals, Inc., | |

| Mr. Plummer currently serves as a business consultant/advisor (since February 2019); senior advisor of United Rentals Inc., a publicly traded equipment rental company (October 2018 — January 2019), and before that as its Executive Vice President and Chief Financial Officer (December 2008 — October 2018), where Mr. Plummer was responsible for the development of the company’s finance activities, investor relations, andco-led its merger, acquisition and divestiture strategies; Chief Financial Officer of Dow Jones & Company, Inc., a publishing and financial information firm (2006 — 2007), where Mr. Plummer set policy for global finance and corporate strategy; Vice President and Treasurer of Alcoa, Inc., an industrial corporation (2000 — 2006), where Mr. Plummer was responsible for global treasury policy and relationship management with commercial and investment banks; director and audit and compensation committee member of Waste Management, Inc., a publicly traded waste management and environmental services company (since August 2019); chairman and a member of the audit committee of Nesco Holdings, Inc., a publicly traded specialty rental equipment to the electric utility, telecom and railend-markets (since April 2019); director of Venture Metals, Inc., a privately held metal recycling company (since August 2019); director and member of the audit committee and technology committee, John Wiley & Sons, Inc., a publisher and service provider in the scientific research, higher education and professional development fields (2003 — 2019); director, UIL Holdings, Inc., an electric and natural gas utility company (2013 — 2015). | |

John T. Turner • Independent Director since September 2019 • Governance and Nominating Committee (Chair) • Audit Committee • Age 63 | Skills and Qualifications: Mr. Turner’s qualifications to serve on the board include his experience in business management, corporate strategy development, including international business, mergers and acquisitions and risk assessment. John T. Turner has served as Chairman of the board of the W.C. Bradley Co., a privately held consumer products and real estate company (since April 2018); director of W.C. Bradley Co. (since 1999); director of TSYS (2003 — September 2019) and chair of its Nominating and Corporate Governance Committee; various capacities with W.C. Bradley Co. and/or its subsidiaries, including President of Bradley Specialty Retailing, Inc. (1979 — 1999). |

There is no family relationship between any of our executive officersNEOs or directors. ThereOther than as described below, there are no arrangements or understandings between any of our directors and any other person pursuant to which any of them was elected as a director, other than arrangements or understandings with the directors solely in their capacities as such.

1220 – GLOBAL PAYMENTS INC. | 20172020 Proxy Statement

Board and Corporate Governance

Proxy Access

After engaging in outreach with certain of our shareholders and considering the viewpoints of governance experts and advisors, we believe that the Company should proactively amend its bylaws to adopt proxy access provisions consistent with market practice and other S&P 500 companies. Once and if amended by our board of directors, the bylaws would permit a shareholder, or a group of up to 20 shareholders, owning an aggregate of at least 3% of the Company’s outstanding shares of common stock continuously for at least three years, to nominate and include in the Company’s annual proxy materials director nominees constituting the greater of two or 20% of the board, provided that the shareholder(s) and nominee(s) satisfy certain procedural and eligibility requirements specified in the bylaws. We believe these parameters balance the benefit to our shareholders with the challenges related to possible proxy contests, turnover in board seats and the challenges of integrating new qualified directors. We intend to propose to the board of directors the amendment to the Company’s bylaws to include the proxy access provisions at the next regularly scheduled meeting of the board of directors.

OurThe board of directors is chaired by Mr. Jacobs, one of our independent directors. Our board believes that Mr. Jacobs’ service as Chairman enhances the independent oversight of management, while continuing to provide the decisive leadership necessary for an effective Chairman. From his 16-year tenure asdoes not have a member of our board and 14-year tenure as either Chairman of the Board or lead director, Mr. Jacobs has acquired a deep knowledge of our history and culture as well as the issues, opportunities and challenges facing our business. As a result, our board believes that Mr. Jacobs is well-positioned to ensure that the board’s time and attention is focused on the most critical matters.

Our Corporate Governance Guidelines do not express a formal policy on whether the same personroles of Chairperson and Chief Executive Officer should serve asbe separate or combined. The Company’s Corporate Governance Guidelines provide that if the ChairmanChairperson of the Board andboard is not an independent director, then the Chief Executive Officer. Although our Chairman ofboard shall appoint a lead director, who shall be an independent director. If the BoardChairperson is an independent director, if in the futureboard may appoint a non-independent director serves aslead independent director.

In connection with the merger with TSYS, Mr. Woods was appointed Chairman of the board and Mr. Cloninger was appointed Lead Independent Director of the board. Until the 2022 annual meeting of shareholders, Mr. Woods and Mr. Cloninger may not be removed from their respective positions without the affirmative vote of at least 75% of the board.

Chairperson of the Board the board will appoint a lead director to fulfill the following responsibilities:Duties

| ✓ | Presides at all meetings of the board (including all executive sessions ofnon-employee directors); |

| ✓ | Establishes the agenda and meeting schedules for board meetings; |

| ✓ | Confers with the Chief Executive Officer on the Company’s strategy and strategic plan; |

| ✓ | Generally approves information provided to the board, board meeting agendas and meeting schedules to ensure there is sufficient time for discussion of all agenda items; and |

| ✓ | Presides over shareholder meetings. |

Lead Independent Director Duties

| ✓ | Presides at executive sessions of the board’s independent directors; |

| ✓ | Serves as liaison between the Chairman and independent directors; |

| ✓ | Serves as a liaison between management, including the Chief Executive Officer, and the independent directors; |

| ✓ | Assists in creation of agenda and meeting schedules for board meetings; and |

| ✓ | Approves retention of consultants who report to the full board. |

At least a majority of our directors, and all of the members of our Audit Committee, Compensation Committee and Governance and Nominating Committee, must be “independent” based on the listing standards of the New York Stock Exchange, or the NYSE. Each year, our board of directors reviews the independence of our directors and considers, among other things, relationships and transactions during the past three years between each director or any member of his or her immediate family, on the one hand, and our Company and our subsidiaries and affiliates, on the other hand.

The purpose of the review is to determine whether any such relationships or transactions were inconsistent with a determination that the director is independent as defined under the NYSE listing standards. In February 2017, our board of directors reviewed the independence of our directors and determined that all of our directors, except Messrs. Baldwin and Sloan, are independent under the NYSE listing standards.

GLOBAL PAYMENTS INC. |2017 Proxy Statement– 13

The NYSE listing standards provide that to qualify as an “independent” director, in addition to satisfying certain bright-line criteria, our board of directors must affirmatively determine that a director has no material relationship with our Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with our Company). Additional independence requirements established by the SEC and the NYSE apply to members of the Audit Committee and the Compensation Committee. Specifically, Audit Committee members may not accept, directly or indirectly, any consulting, advisory or other compensatory fee from our or any of our subsidiaries other than their directors’ compensation, and they may not be affiliated with our Company or any of our subsidiaries. In addition, when affirmatively

GLOBAL PAYMENTS INC. |2020 Proxy Statement– 21

Using these standards for determining the independence of any director who will serve onits members, the board determined that the following directors are independent:

| Kriss Cloninger III | John G. Bruno | Ruth Ann Marshall | ||

| F. Thaddeus Arroyo | William I Jacobs | Connie D. McDaniel | ||

| Robert H.B. Baldwin, Jr. | Joia M. Johnson | William B. Plummer | ||

| John T. Turner |

In addition, each member of the Audit Committee, the Compensation Committee our board of directors must consider all factors specifically relevant to determining whether a director has a relationship to our Company that is material to that director’s ability to be independent from management in connection withand the duties of a member of the Compensation Committee, including (i) the source of compensation of the director, including any consulting, advisory or other compensatory fee paid by our Company to such director; and (ii) whether the director is affiliated with our Company, our subsidiaries or our affiliates.

When making recommendations to our board of directors regarding director candidates, our Governance and Nominating Committee evaluates candidates primarily based onis independent.

The Governance and Nominating Committee believes that diversity is an important factor in determining the following criteria:

In lieu ofconsiders it in making nominee recommendations, although it does not have a formal diversity policy, as part of our Governance and Nominating Committee’s evaluation of director candidates and in addition to other standards the committee may deem appropriate, the committee considers whether each candidate, if elected, assists in achieving a mix of board members that represent a diversity of background, race, gender and experience, among other criteria. The committee seeks members from diverse backgrounds who combine a broad spectrum of relevant industry and strategic experience and expertise that, in concert, offer us and our shareholders diversity of opinion and insight in the areas most important to us and our corporate mission. The committee considers the independence of candidates for director nominees, including the appearance of any conflict in serving as a director. Candidates for director nominees who do not meet these criteria may still be considered for nomination if the committee believes the candidate will make an exceptional contribution to our Company and our shareholders. In evaluating nominees, the committee also takes into account the consideration that members of the board of directors should collectively possess a broad range of skills, expertise, industry knowledge and other knowledge, business experience and other experience useful to the effective oversight of our business.

policy. The Governance and Nominating Committee considers candidates for director who are recommended by other members of the board of directors and by management, as well as those identified by any outside consultants who are periodically retained by the committee to assist in identifying possible candidates. The committee will evaluate potential nominees for open board positions suggested by shareholders in accordance with our policies for shareholder proposals and on the same basis as all other potential nominees. See “Questions and Answers About Our Annual Meeting and this Proxy Statement — May I Propose Actions for Consideration at Next Year’s Annual Shareholder Meeting?” for additional information about our policies for shareholder proposals.

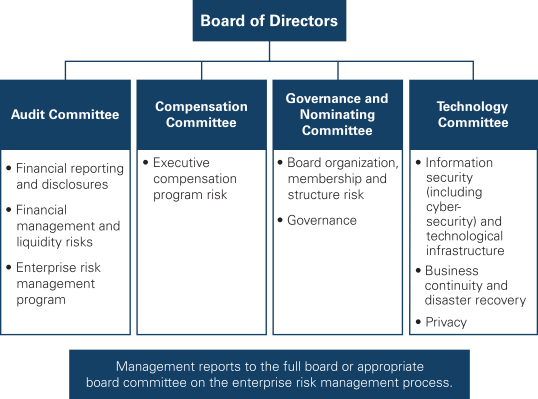

Our board of directors has established five standing committees, which include the Audit Committee, the Compensation Committee,Key factors the Governance and Nominating Committee the Risk Oversight Committee and the Technology Committee, all of which are comprised exclusively of non-employee directors. The Audit Committee, the Compensation Committee, and the Governance and Nominating Committee are comprised exclusively of independent non-employee directors.considers when determining whether to appoint directors include:

•Experience — Particular skills and leadership experience that are relevant to the Company’s strategic vision •Diversity — Diversity of background, race, ethnicity, gender, qualifications, attributes and skills •Age and Tenure — The age and board tenure of each incumbent director •Board Size — The committee periodically evaluates whether a larger or smaller board would be preferable, depending on the board’s needs and the availability of qualified candidates •Board Independence — Independence of candidates for director nominees, including the appearance of any conflict in serving as a director •Board Contribution — Integrity, business judgment and commitment |

1422 – GLOBAL PAYMENTS INC. | 20172020 Proxy Statement

The board has identified the following table provides information about current committee membership forkey qualifications and experience that are important to be represented on our board as a whole in light of our current business strategy and expected needs. The charts below indicate how these qualifications are represented on our board based on information provided by our directors. Information regarding each committee:director’s skills and qualifications can be found within their individual biographies on pages 15-20.

|  |  |

|  | |||||||||||||||

|  | ||||||||||||||||||||||||

|  |  | |||||||||||||||||||||||

|  |  | |||||||||||||||||||||||

|  |  | |||||||||||||||||||||||

|  |  | |||||||||||||||||||||||

|  |  | |||||||||||||||||||||||

|  |  |  | ||||||||||||||||||||||

|  |  | |||||||||||||||||||||||

| |||||||||||||||||||||||||

|   |  | |||||||||||||||||||||||

|   | ||||||||||||||||||||||||

Chair

Chair  Member

Member  Financial Expert

Financial Expert(5)

|

|

indicates board |

qualification

We periodically review our board’s composition to ensure that we continue to have the right mix of skills, background and Attendancetenure. The board currently believes that an appropriate size is seven to twelve members, allowing, however, for changing circumstances that may warrant a higher or a lower number. The Governance and Nominating Committee considers director candidates suggested by members of the committee, other directors, shareholders and management, and has engaged the services of third party firms to assist in identifying and evaluating director candidates.

GLOBAL PAYMENTS INC. |2020 Proxy Statement– 23